Your SaaS company is growing, and each stage brings new finance and accounting (F&A) challenges. As your focus shifts from achieving product/market fit, to building a repeatable sales process, to scaling the business, F&A roles and responsibilities must evolve. Each of these stages highlight the need for experienced financial leadership in the form of a SaaS CFO or Controller in different ways.

We’ve talked about specific CFO duties for SaaS businesses before: How they align SaaS accounting and finance to drive growth, the best SaaS CFO interview questions, and the advantages of outsourced CFO services.

Now it’s time to consider the essential CFO duties for each SaaS growth stage—to narrow down the wide tranche of F&A needs into the leadership responsibilities that matter most today, and as your firm grows.

The Growth Stages of a SaaS Business

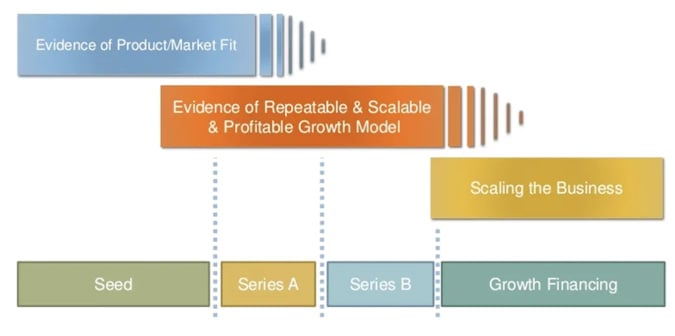

David Skok, an experienced and inspiring venture capitalist, splits SaaS business growth into three key stages:

- Finding the right product/market fit

- Building a repeatable, profitable, and scalable sales model

- Scaling up the business

This is a helpful framework for understanding CFO duties. At each stage, you can ensure your financial leadership evolves to be 100% focused on the right priorities. It’s important to note that this is not an exhaustive list of responsibilities—instead, we’re focusing on the most critical CFO duties.

CFO Duties for All SaaS Growth Stages

Before we get into specific duties at each growth stage, let’s take a step back. There are several finance and accounting responsibilities that apply to every stage for most SaaS companies. Although the scope of these will change over time, they remain a vital and common set of CFO duties.

Stakeholder management:

- Preparing and presenting accurate financial reporting and SaaS metrics to internal and external stakeholders.

- Coaching the leadership team and management board ahead of important meetings.

- Providing additional context and interpretation to tell the story of your SaaS business.

Budget preparation and control:

- Understanding and analyzing SaaS business strategies and goals.

- Creating budgets that prioritize appropriate activities to meet strategic goals.

- Reviewing spend against departmental budgets to check progress and adjust as needed.

Cash management:

- Overseeing bookkeeping, accounting, and financial control activities.

- Ensuring healthy cash reserves and flow of money through the SaaS business.

- Managing payroll, income, expenses, reports, and other day-to-day activities.

Capital allocation:

- Understanding current capital funding sources and cash availability and cash flow statement.

- Assigning capital based on strategic planning and budgetary priorities.

- Managing debt repayments and venture capital expectations.

SaaS KPI management:

- Developing SaaS metrics and educating stakeholders.

- Aligning management on KPIs at a departmental level.

- Reporting on and interpreting KPIs to support data-driven decision making.

While these core CFO duties may be considered “essential” for every SaaS business, there’s much more to finding the right leadership candidate. It begins with understanding how the role evolves at each stage of a SaaS companies' growth.

CFO Duties for SaaS Growth Stage 1: Product/Market Fit

During this initial stage, you’re developing and refining your software-as-a-service product, identifying your target buyers, and ensuring your solution can meet their needs.

Key CFO duties at this stage are:

- Raising seed capital to fund early research, development, prototyping, and MVP.

- Setting up basic accounting systems to accurately capture and report on ARR and MRR.

- Establishing tight internal controls and reporting.

- Validate progress toward achieving product/market fit by ensuring customers pay for and renew their subscriptions.

- Maintaining discipline to truly achieve product/market fit prior to building a repeatable sales model.

A CFO should focus basic SaaS accounting software around key metrics for the product/market fit stage. Annual recurring revenue and monthly recurring revenue are critical to demonstrating customer demand for your software-as-a-service product, and recurring revenue is your only pathway to sustainable growth. Accurate reporting on the right KPIs is imperative when building a compelling story for investors.

Getting contracts signed and invoices paid during the early life of your business helps to position you for a seed round. Internal controls are critical too, as they will be tested throughout every growth stage. Most importantly, validating product/market fit is essential before moving to the next phase.

SaaS CFO Duties for Growth Stage 2: Building a Repeatable Sales Process

Now that you’ve achieved product/market fit, it’s time to build a consistent sales process that can easily replicate. This will be the growth engine that scales your business.

Key CFO duties at this stage are:

- Getting scalable systems in place so you’re prepared to invest in growth.

- Achieving profitable unit economics.

- Raising Series A/B funding to support product development, new hires, and other growth initiatives.

- Holding the sales team accountable for pipeline math and close rates.

- Measuring and fine-tuning your sales efficiency metrics until they demonstrate you’ve achieved a repeatable, scalable and profitable sales process before moving to the next step and deploying the capital required to scale.

Source: David Skok, www.forentrepreneurs.com

While it can be tempting to invest in rapid expansion once product/market fit has been achieved, it’s imperative for a SaaS CFO to establish scalable processes and systems first. This is also the time to really concentrate on unit economics, understanding how customer acquisition cost (CAC), lifetime value (LTV), and churn impact profitability and sales efficiency (Magic Number, CAC ratio). SaaS companies that don’t take the time to nail each of these areas before scaling will find it extremely difficult to course correct later.

By leading a successful Series A/B funding effort, a CFO will unlock the capital needed to test, refine, and build out your sales strategy and team. This will also require accurate and methodical reporting of KPIs, and the expertise to analyze and interpret them for informed decision making.

CFO Duties for SaaS Growth Stage 3: Scaling the Business

This is the final SaaS growth stage prior to a successful exit. In this phase you’re raising capital, deploying it, and scaling fast.

Key CFO duties at this stage are:

- Raising growth capital which requires generally accepted accounting principles (GAAP) financial statements, budget, watertight revenue recognition, and a compelling financial story.

- Monitoring and improving sales efficiency metrics.

- Coaching leaders and other stakeholders to own and use SaaS KPIs and Profit & Loss reports for their respective departments.

- Communicating with potential acquirers and managing the exit process, inclusive of due diligence.

- Sourcing, screening, and managing the deal and integration process if you want to grow through acquisition.

- Evolving and monitoring controls as your SaaS firm scales.

- Complying with sales tax requirements, avoiding audit findings, and planning for taxes.

- Ensuring that “net new ARR” is increasing on schedule, as it’s the clearest indicator of growth and the basis for calculating enterprise value.

At this stage, a SaaS CFO is building toward a successful exit. This means increased scrutiny and compliance, together with critical stakeholder management. Stricter controls will generate accurate financials, drive efficient growth, and maximize valuation.

Growth will bring additional sales tax exposure, so a CFO will need to have a strategy in place to minimize liability. A good portion of time will also be devoted to fundraising activities and keeping the bank, board, and investors informed and constructively engaged.

A Scalable Solution for SaaS Accounting and Finance

Outsourced CFO services provide accounting and finance expertise for SaaS businesses on a fractional basis. For early stage firms, that might take the form of limited CFO- or controller-led oversight. As firms grow, financial leadership, team size, and involvement can seamlessly scale up to meet expanding needs.

At all growth stages, SaaS firms will find a right-sized solution that owns the entire finance and accounting function from end to end, so they can confidently advance toward a successful exit.

The decision to bring on CFO-level leadership is critical. The best CFO candidate for your firm will combine expert knowledge of the SaaS growth model with a deep understanding of the essential responsibilities at each stage of growth. Ready to take the first step? Learn how SaaS CFO services can be tailored to your needs. Schedule an introduction to Driven Insights today and get a free, custom proposal.