Optimizing your accounting practices for the SaaS space is critical to running a healthy SaaS business, but it’s not enough to transform it into a market leader. For that, SaaS finance expertise is essential. In this article, you'll learn how accounting and finance fit together, the functions and roles in each, how you can benefit, and the growth stages where they matter.

Tracking deferred revenue on your balance sheet and periodically cobbling together your customer acquisition cost (CAC) for a one-off meeting is no longer enough. Your SaaS company is expanding, and you’re outgrowing a pure SaaS accounting function. It’s time for the next step—layering in wider SaaS finance expertise to measure your key performance indicators (KPIs), price correctly, get investment, and build SaaS-focused financial management into your business DNA.

Deciding when and how to bring in more wide-ranging SaaS financial expertise can be tough. What do you need at this stage in your growth? How do you find the expertise you’re looking for? Why are SaaS financial metrics important to your firm? What's the distinction between SaaS accounting and SaaS finance anyway?

It’s a lot to think about. Fortunately, it's all we think about too.

Strong SaaS Accounting is Fundamental to Successful SaaS Finance

Sound accounting methods for SaaS businesses are critical to building a successful finance function and producing sound financial statements. Finance and Accounting (F&A) are interdependent—you need robust contract capture, tight revenue recognition, and generally accepted accounting principles (GAAP) compliant reporting as part of your SaaS accounting foundation.

SaaS finance then takes that accounting information and builds on it to raise and deploy capital, marshal resources, and guide value creation.

Examples of how SaaS accounting feeds directly into a larger finance function include:

- Leveraging SaaS revenue recognition to calculate Annual Recurring Revenue (ARR) and other KPIs that help drive SaaS valuation and investor interest.

- Embracing the tradeoffs of which costs should and shouldn’t be included in the cost of acquiring new customers and getting buy-in from investors and prospective suitors

- Using business cost center information and transactions to create departmental financial metrics and SaaS metrics that focus and guide team-based priorities.

- Complying with GAAP accounting requirements and reporting to fuel fundraising pitches.

- Optimizing SaaS sales tax exposure through state-specific reporting and revenue.

- Accurate capture of income and expense to inform capital efficient budgeting

SaaS finance is transformative, but it relies on the raw materials of good SaaS accounting to turn lead into gold.

Differences Between SaaS Accounting and SaaS Finance: Functions and Roles

Saas Accounting Functions and Roles

A SaaS accounting team covers everything from income and expense transaction entry to the monthly close. The accounting function is tightly choreographed, resulting in strong GAAP financial reporting.

In an accounting function, the role progression could look like:

Accountant or Bookkeeper > Senior Accountant > Accounting Manager > Controller > CFO.

The typical responsibilities of a SaaS accounting department include:

- Income and expense transaction entry and accurate classification.

- Managing the “order to cash” process from end to end.

- Robust expense control and strong cash management.

- Preparing and processing payroll.

- Utilizing SaaS accounting software to produce standard accounting reports including balance sheet, profit and loss, and cash flow statements.

- Carrying out SaaS specific functions including revenue recognition, liability management, sales tax, and GAAP accounting requirements.

- Complying with regulatory requirements.

- Providing data to support a CPA for income tax reporting and the year-end audit.

SaaS Finance Roles

Finance roles are focused on the bigger picture. They help to analyze and contextualize the data produced by accounting, and then use that insight to drive growth.

When you bring SaaS finance into the mix, a typical progression might be: Analyst > Finance Manager > Director of Finance > CFO. Depending on its size, an SMB SaaS firm might only have one person for all of these roles.

SaaS finance teams play several key roles:

- Developing and agreeing on foundational KPIs that properly reflect the current state-of-play and your growth trajectory.

- Aligning, cascading, and customizing key metrics and other information at a departmental level for data-driven decision making.

- Ensuring that your unit economics support your transformation into a profitable, investment-worthy SaaS business.

- Creating a capitalization strategy for acquiring funds at each SaaS growth stage.

- Establishing and refining your SaaS pricing strategy.

- Crafting and communicating your financial roadmap to market share expansion to persuade people to invest.

- Managing stakeholders across your leadership team, board, bank, and investors.

- Leading and supporting acquisition and/or exit opportunities.

These Two Types of Roles Are Not Easily Interchangeable

You can see that there’s a huge difference between each discipline and the roles it requires. Many SaaS companies expect their accountants to take on wider finance roles, and that often creates new problems. The right SaaS finance specialists become the force multiplier for your firm, preparing it for investment and an exit.

These experts make all the difference—you don’t want to blow this!

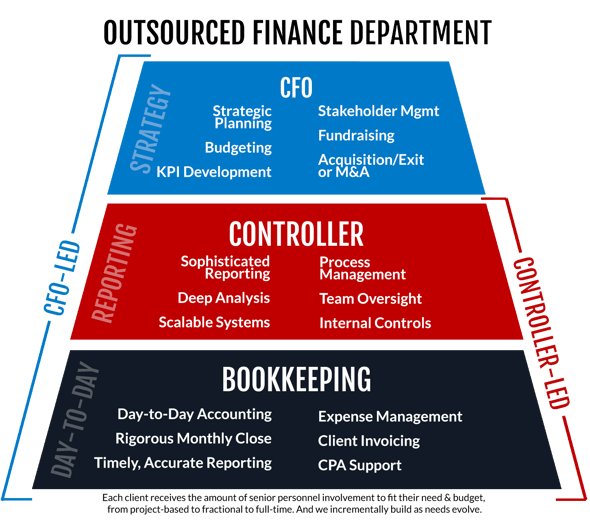

Outsourced CFO services and outsourced Controller services are an efficient way to meet growing finance needs for your SaaS business.

How Your SaaS Firm Benefits from SaaS Accounting and Financing

The right mix of F&A drives significant benefits:

- Establishing F&A roles for your firm: Understanding the key differences between the two disciplines and resourcing up each one based on your growth stage.

- Meeting your compliance standards: Ensuring that you meet GAAP guidelines and comply with ASC 606.

- Capturing revenues and costs: Developing confidence in the financial health of your business and the information you share with investors.

- Strengthening data-driven decision making: Developing and driving KPIs on a business-wide and department-specific level.

- Maximizing company valuation: Developing robust calculations and standards to signpost and forecast growth.

- Getting investment: Identifying sources of debt and equity and presenting financial statements and data in a compelling way to attract funding.

- Growing in a scalable and profitable way: Ensuring that your investment and budgets align with sustainable, planned growth.

- Exit: Creating and executing exit plans for mergers, acquisitions, or IPOs that generate meaningful stakeholder value.

When You Need SaaS Finance During Your Business Growth

You’ll need a SaaS accounting function from the moment you launch your business—that requirement for rigorous record keeping, reporting, and compliance never goes away. As you scale your business, you’ll naturally build out your accounting department in line with growth.

Working out when you need fractional or full-time SaaS finance services isn’t quite as straightforward. There are a few different models for understanding SaaS growth stages.

We believe that SaaS finance can be particularly helpful during these periods:

- Bringing in a finance expert to test the business model to ensure sound economics, budgeting, pricing, and capitalization strategy.

- Scaling up SaaS product growth and getting necessary resources to support wider market penetration.

- Tailoring KPIs to your SaaS business.

- Reducing churn, keeping CAC down, and maximizing ARR.

- Continuing on a profitable growth trajectory.

Finance functions like developing KPIs, managing stakeholders, and using data-driven decision making matters at every stage of SaaS growth—from inception through to exit. Reviewing your pricing strategy is critical to understanding what people will pay for your product and balancing acquisition, existing customer retention, and profitability of a customer lifetime.

Prior to major investments, you’ll want to establish a strong capitalization plan, a budget, and capital allocation strategies.

Accelerating your growth will largely depend on your finance team’s skill at:

- Sound budgeting

- Raising the right type of capital from the right capital sources at the right time

- Allocating that capital wisely, managing cash flow along the way

- Managing the business against the right KPIs at every stage of growth.

How to Scale Up Your SaaS Finance Capabilities

You’ve decided it’s time to layer in SaaS finance expertise on top of your accounting, but where do you start? Well, you don’t need to jump in, feet-first. While you can certainly benefit from hiring a full-time SaaS finance team and CFO, we’d suggest a more gradual approach, based on your growth stage.

Why are so many SaaS companies turning to outsourced accounting and CFO services? There are several great reasons. You can:

- Rapidly bring in a deeply experienced, highly skilled accounting and finance team.

- Align your entire organization around the KPIs, technology, and processes that matter most at each stage of growth.

- Choose the most cost-effective solution and have it scale with your needs.

Most importantly, you can stop making decisions in the dark, and leverage the critical insights that will pave the way for maximum valuation and a successful exit.

If a tailored, scalable, team-led solution for SaaS finance and accounting sounds like the right fit for your business, take the first step today. Get a free, custom proposal from Driven Insights.