The financial priorities of your SaaS business will change as you move through each growth stage. In the initial phases, you’ll likely be working toward product/market fit, with a strong focus on bringing in customers, regardless of the acquisition cost. As your business matures, you’ll streamline your unit economics to strengthen long-term profitability. A combination of rapid growth and good margins is vital to a high company valuation, and that means understanding your LTV to CAC ratio.

The ratio is a key SaaS metric that compares your Customer Acquisition Cost (CAC) with your Customer Lifetime Value (LTV). This ensures the total revenue/gross profit you collect from a customer significantly outweighs the cost of acquiring them in the first place. That’s essential to investors—as they pump money into your sales and marketing to fuel growth, they can be confident that the revenue returns from those customers are multiples of the funds the investors are providing.

Your LTV:CAC ratio isn’t just a tool for fundraising. It will provide you with a deep insight into the financial performance of your business, helping you prioritize the activities that maximize sustainable growth. In this article, we’ll explore the LTV to CAC ratio, why it’s important, how to calculate it, and how to turn that insight into profit-driving activities in your business.

What is the LTV:CAC Ratio?

Your LTV to CAC ratio is a measure of the total value of a customer (lifetime value) relative to the cost of acquiring them (customer acquisition cost). It helps you determine whether the amount you pay to acquire customers is sustainable, compared to the total revenue and profit you expect to earn over their lifetime of using your SaaS product.

LTV and CAC are both highly nuanced SaaS metrics—a strong understanding of each is critical to developing a sound LTV:CAC ratio.

Calculating and Understanding Lifetime Value

LTV measures the value of a customer over the entire lifespan of the customer relationship. You’ll find details on how to calculate LTV in our SaaS metrics LTV guide. There are several ways to calculate LTV, based on “net churn,” “gross churn,” and “logo churn.”

Calculating and Understanding Customer Acquisition Cost

CAC refers to the total cost of acquiring a new customer based on sales and marketing spend—from the salaries of your sales team to the costs of advertising. You’ll find details on how to calculate CAC in our SaaS metrics CAC guide. Just like LTV, there are several factors that impact the CAC calculation. For example, you’ll need to properly evolve your Chart of Accounts to enable an accurate CAC calculation.

Related Content: The SaaS CEO’s Guide to Finance & Accounting

The comprehensive resource for ALL aspects of your SaaS F&A function.

How to Calculate Your LTV:CAC Ratio

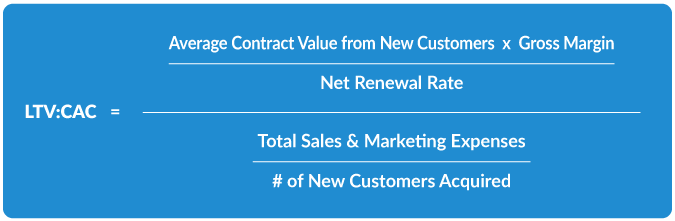

To calculate LTV to CAC ratio, you'll need five pieces of information:- Average Contract Value from your New Customers

- Gross Margin

- Net Renewal Rate (NOTE: this variable can change if you substitute in different churn rates)

- Total Sales and Marketing Expenses

- Number of New Customers Acquired

- Multiply Average Contract Value from New Customers with your Gross Margin.

- Divide this amount by your Net Renewal Rate.

- This gives you your LTV for the ratio calculation.

- Divide Total Sales and Marketing Expenses by the Number of New Customers Acquired.

- This gives you your CAC for the ratio calculation.

- Finally, divide your LTV by your CAC for the LTV:CAC ratio.

Keep in mind, regardless of how you choose to calculate this KPI, you'll want to ensure all of your leaders and stakeholders are using the same calculation and understand exactly what it's telling them. It's best practice to include a comprehensive list of all KPI definitions with your monthly reporting, so everyone is aligned behind a common understanding.

Why Your LTV:CAC Ratio is Important

From a fundraising perspective, your LTV to CAC ratio shows investors that you can leverage their money to acquire customers that will generate multiples of revenue and drive up profits and returns. VC firms will use your LTV:CAC ratio alongside other KPIs to decide where, when, and how much to invest.

From a business perspective, the LTV to CAC ratio neatly rolls up sales efficiency, financial health, and growth potential into one metric. It highlights several critical factors:

- How much of a revenue (or gross profit, depending on how you choose to calculate LTV:CAC) return you can expect to see from every dollar you spend acquiring customers.

- Whether you can optimize sales efficiency further, particularly through unit economics.

- How you’re performing as a benchmark compared to your peers and competitors.

- The expected “lifetime return” on your CAC investment, and how that scales up as you invest in growth.

As a rule of thumb, you’ll want to aim for a LTV:CAC ratio of three or higher.

Some SaaS industry experts argue that the LTV:CAC ratio is the most important metric of all for SaaS firms, while others disagree.

Certainly, the ratio is the gold standard for measuring and improving on your long-term profitability. Despite this, it’s important not to view the LTV:CAC ratio in isolation. It’s essential to use it alongside other KPIs like ARR, churn, the Rule of 40, SaaS Magic Number, and others, to gain a complete picture of your financial health and potential.

How Companies Can Use the LTV:CAC Ratio

The CEO and CFO can use the ratio to demonstrate profitable growth, show progress to the board and stakeholders, and identify areas for improvement. Your financial leadership team will also cascade the metric down into the business as a powerful way to align your departments and teams around profitability and empower them to influence and evolve your firm’s LTV:CAC.

Individual department heads and team leads can focus on the different elements that drive the LTV:CAC ratio calculation—for example, reducing sales and marketing costs, boosting gross margin, or improving net renewal rates. Some areas that directly contribute to a higher ratio include:

- Marketing: Maximize contract value and reduce acquisition, renewal, and retention costs. Additionally, reducing the cost per lead and improving conversion each directly impacts CAC. And focused efforts on the Ideal Customer Profile (ICP) improves retention. Lastly, by effectively marketing to existing customer base, the marketing department can drive engagement to decrease churn and result in expansion revenue to build LTV.

- Sales: Optimize revenue for each new customer (LTV), expand service offerings for existing customers (LTV), and reduce sales costs (CAC). Drives sales leadership to focus their team on the ICP (Churn) and efficient use of sales resources and channels for each ICP (CAC).

- Customer success: Deliver a cost-efficient product/service (Gross Margin) and maximize customer satisfaction and retention (Churn).

- Product development and support: Streamline product development to drive sales and ensure stable performance to drive retention. DevOps can drive Gross Margin enhancements while increased automation can also reduce required Customer Success time thus boosting Gross Margin.

Use LTV:CAC Ratio to Fuel Growth

Like any SaaS metric, your LTV:CAC ratio is only as helpful as it is accurate. Understanding not only how to calculate SaaS metrics, but the context for those KPIs, is critical to efficient and profitable growth. Efficient, sustainable growth helps to share the story of your business, demonstrates your worth as a fundraising target, and drives up your valuation.

This all highlights the need for a strong, financial leader to work with your CEO—identifying growth areas for each stage and providing the insight for the right data-driven decisions. Learn more by scheduling an introduction to Driven Insights today. You’ll receive a free proposal and discover a cost-effective way to have all the finance and accounting resources your SaaS business deserves, today and as you grow.