When it comes to key SaaS metrics, Annual Recurring Revenue (ARR) is the one every stakeholder has their eyes on. When a SaaS company is experiencing ARR growth, it’s a signal to founders, CEOs, investors, and others that the subscription business is building momentum. Growing annual recurring revenue will drive enterprise value, help to attract investors, and play a major role in critical decisions at every stage of a SaaS firm’s growth.

However, it’s far too common for SaaS companies to miscalculate and misuse annual recurring revenue. This leads to flawed reporting, misguided decisions, and inconsistencies that erode investor confidence—ultimately taking a toll on valuation.

Getting annual recurring revenue wrong has wide-reaching implications.

And, it’s easy to get wrong. What should be included in your company's ARR? How should your company's ARR be calculated? How should you recognize revenue across different pricing plans and contract terms? If the CEO, board, and management of your company expect different answers to questions like these, it’s impossible to have an accurate view of company health, and you should align behind a written SaaS KPI glossary because your SaaS firm is flying blind.

In this article, we’ll explain the right way to calculate and use ARR, how to avoid critical mistakes, and how to align your entire organization around this all-important SaaS metric, so you’ll always be making informed decisions that fuel growth.

What is ARR?

Annual Recurring Revenue (ARR) is defined as the value of recurring revenue from recurring subscriptions over defined terms, normalized for a one-year period. An essential metric for the SaaS subscription model, ARR represents the amount of expected recurring revenue generated from recurring billing cycles over the next 12 months at the current run rate, at any given point in time.

At a high-level, ARR growth translates into positive momentum for early stage SaaS companies, and continues to send the right signals to investors and buyers down the road. While it isn’t a stand alone metric, a SaaS firm won’t be able to assess product/market fit, unit economics, sales efficiency, or the potential for future earnings without it.

Why Annual Recurring Revenue (ARR) is Important for a SaaS Business

SaaS Annual Recurring Revenue (ARR) is one of your most important KPIs for several reasons:

- SaaS valuations are often based on a multiple of ARR. While many other factors come into play, Annual Recurring Revenue is the key value driver.

- Changes in ARR drive a deeper understanding of customer acquisition, expansion, contraction, and churn.

- ARR is a component of several other key SaaS metrics.

- Essential to developing financial projections, ARR helps you plan around future cash flows.

When subscription businesses get ARR right, leadership has an accurate measure of a company's growth and a clear view into the activities that are impacting it. The wealth of data that stems from ARR will constantly guide critical decisions about refinements to your business model and, ultimately, will help to craft a compelling story for investors.

How to Calculate SaaS ARR (with Examples)

As a critical measure of business health and an essential tool for financial projections, the importance of correctly (and consistently) calculating ARR cannot be overstated.

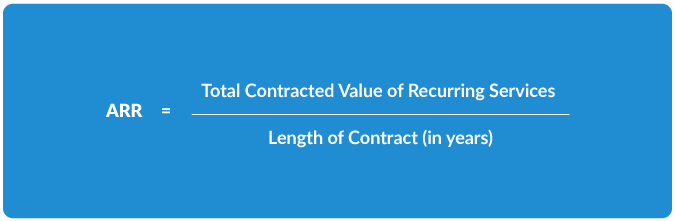

To calculate Annual Recurring Revenue (ARR), divide the contracted amount for recurring services sold by the length of the contract (in years).

Here are a couple of examples:

- If the contract amount is $200, and it’s a two-year contract, the ARR is $100.

- If the contract amount is $200 over a six-month contract the ARR is $400.

As mentioned, miscalculating ARR can quickly lead to a cascading stream of problems for SaaS businesses—problems that will have a negative impact on valuation. But, ARR is a relatively simple concept with a straightforward formula. So, how do so many SaaS firms get it wrong?

Misunderstanding and Oversimplifying SaaS ARR

In lieu of the standard ARR calculation, SaaS companies will often substitute other methods in order to arrive at a measure of Annual Recurring Revenue. But, when the nuances of SaaS accounting and the subscription model aren’t taken into consideration, these businesses are incorporating a dangerous amount of guesswork.

Some SaaS teams will use recurring GAAP (generally accepted accounting principles) revenue from their P&L statement over the last twelve months to determine ARR. Others may make ARR calculations by annualizing revenue from the most recent month’s P&L. These methods not only make risky assumptions, they don’t provide enough detail to support data-driven decision making.

Let’s take a look at specific situations where ARR can be easily misunderstood and contribute to guesswork, confusion, and a false sense of company health.

ARR is Not a GAAP Metric

SaaS companies have very specific requirements for recognizing revenue from customer contracts within GAAP (generally accepted accounting principles)—a framework clearly outlined in ASC 606. Unfortunately, these requirements don’t always align with the way management wants to represent ARR.

Here’s an example:

A SaaS firm brings on a new customer with a one-time, $100k implementation fee and an ongoing, annual $100k subscription fee. The firm offers a 100% discount on implementation.

GAAP rules require showing these amounts as a 50-50 split, with the discount spread proportionally across the implementation and the subscription (resulting in $50k for each).

However, if management wants to list the implementation at $0 (so they can take the full $100k subscription as ARR, rather than reduce it by 50%), this conflicts with GAAP rules.

Accounting for Customer Start and Stop Times

This is another area where ASC 606 prescribes a revenue recognition standard that management might not want to align with.

Here’s an example:

A customer signs and their contract begins on December 29, with an annual contract value of $365.

Management wants to recognize the ARR on December 30 as $365. But, if you’re annualizing the revenue according to ASC 606, the recognized revenue on December 30 would only be $3 (only recognizing the portion of the revenue received over the last three days of the year). The rest of the recurring revenue would be pushed to the following year (where the ARR is $353).

There’s a big difference between $3 and $365 so you can only imagine how understated or inflated ARR can be relative to recognized revenue when you’re using actual contract values and you’re multiplying by hundreds or thousands of customer contracts. Please take no shortcuts with your revenue recognition.

Departments, Teams, and Individuals Have a Different Understanding of SaaS ARR formula

Another problem is that it’s not uncommon for various parts of your business to have very different ideas of what ARR actually represents, and how it’s calculated. For example, if you talk to a Customer Success rep about how much ARR they expect to see through renewals over the next month, then you talk to finance and the amounts are different, then you need to resolve those discrepancies.

ARR Should be Helpful

When it comes to SaaS ARR, nuance and interpretation matter—because situations like these abound. Ultimately, ARR should provide financial insight and drive smart decisions and actions. Inaccurate and incomplete data will compromise decision making and lead to erroneous reporting and potentially serious consequences.

How to Use Net New ARR in Your SaaS Business

ARR is an indispensable metric for SaaS companies at every stage, but it’s still just a measure of top-line revenue. To truly harness the power of data-driven decision making to fuel ARR growth and drive maximum valuation, you’ll need to understand the key components that impact revenue growth.

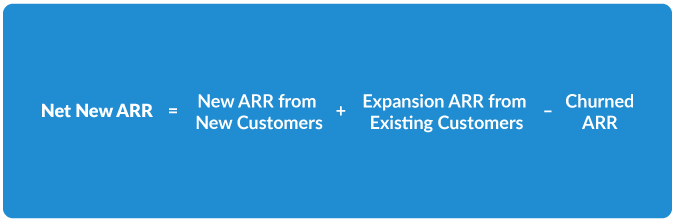

These include:

- Customer churn – loss of revenue due to canceled subscriptions

- Expansion revenue – from existing customers, through upsells, cross-sells, and add-ons

- Contraction revenue – from existing customers downgrading subscriptions

The KPI that captures this perspective is Net New ARR. By examining the impact of churn, expansion, and contraction on revenue, you’ll be able to analyze, understand, and act on the underlying metrics that are directly impacting revenue growth.

Related Content: Choosing the Right Subscription Management Platform

Explore 9 essential criteria for selecting a SaaS billing tool.

With Net New ARR, you can begin to ask why customers expanded, contracted, or churned, and dig deeper to surface the root causes. You have the ability to spot trends, identify opportunities, or address problems. You can prioritize activities and take decisive action, knowing which metrics need to improve and which departments to hold accountable.

Once you’re able to get to this detailed understanding, then you can work on other SaaS KPIs. Any understanding or discussion of CAC payback, lifetime value (LTV), and many other metrics simply won’t be complete without a detailed breakdown of ARR.

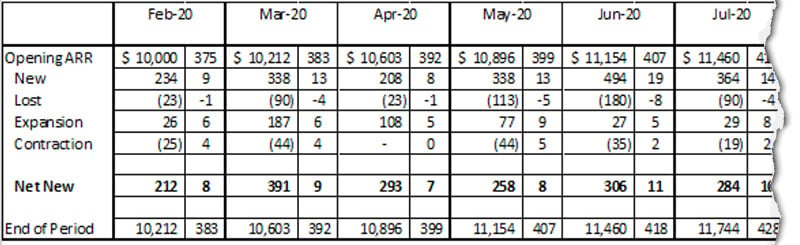

An ARR “waterfall” or “rollforward” provides a detailed breakdown of ARR, so SaaS teams can examine the effects of expansion, contraction, and churn over specific time periods. ARR is one of the most important SaaS KPIs and high growth SaaS firm lean on the ARR waterfall report more than any other.

Understand and Align on Key SaaS Metrics

SaaS metrics are not one-size-fits-all. In fact, one of the essential duties of a SaaS CFO is to develop the right KPIs for their organization, and document how they will be defined, calculated, and interpreted. Each department must be accountable for specific KPIs, and all stakeholders must be aligned with a common understanding of them. ARR is no exception.

For example, early stage SaaS companies need to know when to “step on the gas,” and fuzzy metrics that stem from faulty ARR will send the wrong signal.

For later stage companies, it’s critical to know how efficiently sales and marketing dollars are fueling growth in the form of net new ARR. Here, muddy metrics will paint a distorted picture of company health and discourage investors.

However, when an entire organization aligns on ARR and other SaaS metrics, and demonstrates a consistent, data-driven process, the result is more than operational efficiency—it sends a strong signal to investors and buyers at valuation.

ARR is the Primary Value Driver for SaaS Businesses

ARR growth is the primary driver for SaaS valuation for good reason. It points to demand for your products and services, a healthy market, and future earning potential. When SaaS companies confidently use ARR to guide strategic decision making, they are in an ideal position to raise capital and pursue exit opportunities.

Don’t be tempted to oversimplify annual recurring revenue. Take the time and effort to capture recurring revenue correctly and ensure that all stakeholders align on a common understanding of every metric that impacts it. If you’re going to lock down one thing, lock down your SaaS ARR.

How? With an outsourced CFO service for SaaS companies, even early-stage firms can cost-effectively harness the expertise of high-level financial leadership and a complete finance and accounting team to consistently drive ARR growth and maximize enterprise value.

Learn more by scheduling your introduction to Driven Insights today. You’ll receive a free proposal and discover a cost-effective way to have all the finance resources your business deserves, today and as you grow.