The Best Financing Option May Surprise You

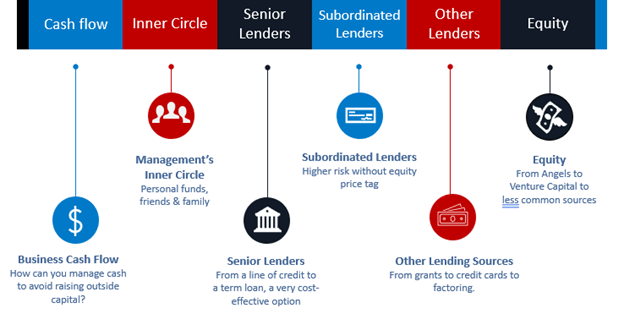

It’s common for business owners to default to a known source of capital when a need arises. Perhaps they turn to the traditional bank loan from the regional bank whose been courting him/her for years. Or maybe they lob a call into the venture capital firm who funded their friend’s firm.

And the actual costs of different kinds of financing aren’t always apparent on the surface. For example, the cost of fundraising isn’t only the cost of capital. It’s also the opportunity cost of spending time on fundraising instead of getting that next sale, improving the sales funnel or driving an efficiency initiative that trims costs. Say nothing of managing to covenants or keeping investors informed and in line, fundraising can become a full time job and if not careful, the costs can outweigh the benefits.

The reality is there are so many options to consider, and choosing the one that best fits your unique situation can make a world of difference in the long run.

Here, in addition to traditional options, we’ll profile many other common sources of capital. We’ll dive into a little detail on each source, exploring the pros and potential pitfalls, and perhaps you’ll find something unexpected that fits your circumstances, your industry, your business growth stage, and other factors.

As we’ll discuss … it’s far from a one size fits all!

Cash Flow or Cash Reserves

Often overlooked, a firm’s cash flow or cash reserves can be a great place to start.

For short-term needs, like navigating a cash shortfall, businesses can manage working capital. To fund a marketing campaign, perhaps hold off for 3 to 6 months on a planned new hire. Or for a sustained investment, redirect a certain amount of cash flow toward a growth initiative

Finding a way to make your firm’s cash resources work avoids the massive distraction of a fundraise and requires no repayment, personal guarantee, or dilution to equity holders.

| Pros | Cons |

|

|

Is cash your King?

A great time to consider this option is if your need is short term, your cash reserves exceed rainy day needs, or if your business can put off investing in another area.

Inner Circle

If the business doesn’t have sufficient cash, there’s still another path worth considering before defaulting to an institutional capital raise. As an owner, could you loan the business some or all the needed capital? Or could you and/or your partners forgo some or all your compensation for a period of time? Think about a family member, friend or former boss who may have the capacity and interest to provide financial support. That support could come in the form of a loan with lenient terms, or it could come as equity at a higher valuation than a VC would allow, thereby minimizing dilution.

Naturally, there’s risk in accepting further investment. A management team is already investing a lot in the business and further investment means less diversification. And taking money from a family member or friend could risk that relationship if things don’t go as expected.

But in the right circumstances, tapping one’s inner circle can lead to enormous savings of time and money.

| Pros | Cons |

|

|

Should I keep it in the family?

Consider this option if your management team’s inner circle has the resources, capacity and interest to help, or if your personal relationships are strong enough to support your plan and any revisions that may occur along the way.

Senior Lenders

One default capital source for small business owners is banks, traditional senior lenders. When you’re looking outside, senior lenders are as inexpensive an option as you’ll find.

Senior loans come in many shapes and sizes:

-

- Line of credit (aka a revolver)

- Equipment financing

- Term loan

- SBA financing

- Bank can use a firm’s cash flow or assets (from AR to PPE) as collateral

There are many flavors of senior debt, but one thing all senior lenders have in common is a low appetite for risk. They want stable, predictable cash flows because that is typically their primary form of repayment. They may want personal guarantees because they want management to have skin in the game (to care deeply) about things evolving as planned… which means the bank can go after your house or other personal assets if things go south.

And senior lenders establish covenants, which are thresholds or ratios that work like guardrails. But the frightening things about covenants is that when one is tripped, the owners are no longer in control… the bank is. Losing control is one of the scariest parts of raising capital.

| Pros | Cons |

|

|

Is it best to stick with tradition?

If your primary form of repayment will come through predictable operating cash flow, and your position is low risk, senior lenders may be your answer.

Subordinated Lenders

Next up, we have subordinated lenders, also known as mezzanine lenders. Subordinated lenders sit behind senior lenders but ahead of equity when it comes to the liquidation waterfall. In other words, if a business were to liquidate, the senior lender would be repaid first. If there were funds remaining after the senior lender was repaid, the subordinate debt provider is next in line. Equity holders are last.

There’s an intercreditor agreement called a subordination agreement that needs to be negotiated between the senior and subordinated lender when both forms of debt exist at the same time. Sub debt providers have a higher appetite for risk, but the cost of capital is significantly more expensive than senior lenders (although still less expensive than equity).

Subordinate lenders often specialize in certain industries or types of business, allowing them to better understand and gauge their risk. They can also take an equity stake, often called warrants, in addition to earning interest.

| Pros | Cons |

|

|

Hearing cheers from the mezzanine?

Consider this option if your investment is riskier, where it can complement or replace the need to raise equity and reduce dilution.

Other “Lenders”

I’m using the word lender loosely to bucket a handful or other options that may have appeal in certain situations.

Factoring is one option. This is selling your receivables or receiving an advance against select receivables. While there are some legitimate factors, be wary that there are also some unscrupulous providers. Keeping this in mind, if options are limited and there’s a short-term cash need that has a foreseeable end, factoring can be a cost-effective option.

Credit cards bear mentioning, but only to say that many business owners (and consumers for that matter) learn the hard way how expensive credit card debt is. These should only be considered as a last resort.

Let’s also put grants in this bucket – that is, grants from foundations, grants from the government, or loans from government sponsored organization. Grants can appear to be “free money” and in some cases, that’s the way it works out. But there are often claw backs or terms where money must be repaid if certain performance criteria aren’t met. In many cases you often need to apply many months in advance of the grant award dates with a far from certain outcome, making grants best suited for funding “nice-to-have” initiatives.

| Pros | Cons |

|

|

Should you think outside the box?

If you have a short-term and modest-in-size cash need one of these other options may fit your need.

Equity

If you haven’t found a source that fits, no worries, there are a VERY WIDE variety of options in this category. There are angels and venture capital (VC), as well as private equity (PE) options to consider. Each of these alone has so many sizes and flavors that we could dedicate a separate guide to the their respective spectrum of sources.

On a related note, a business can also raise money from high-net-worth individuals (think Shark Tank without the audience), or crowdsourcing, where you use a platform to pitch your investment opportunity and a lot of people put in smaller amounts to back it.

| Pros | Cons |

|

|

Can equity get me there quickly?

If pace of growth is critical and your business needs a large investment relative to its size, equity can provide the shot-in-the-arm you need to accelerate growth and take your business to the next level.

Thinking It Through

Funding decisions can change the course of your business trajectory, for better or for worse. And choosing the wrong option can cost more than money, it could lead to loss of control, personal risk, or big distractions. Challenge yourself to think through the whole spectrum of options before defaulting to the usual solution.

At Driven Insights, we help our clients think realistically about what it means to raise outside capital. We have experience helping business owners weigh their options and guiding them to solutions in all of the categories along the spectrum of possibilities.