The CEO of a high-growth SaaS company has plenty of things to worry about on a daily basis. One of their biggest anxieties, however, can simply be the fear of running out of money. One successful client SaaS CEO recently characterized that sense of dread as “raw terror.” He went on to share just how much time and energy he wasted worrying because he didn’t know his firm’s cash runway. A CEO needs to be forward leaning, but before his fear was allayed with tight, transparent cash management, he felt crippled since he lacked the data required to confidently make the tough calls.

Whether investing in early growth or fueling rapid expansion, every decision is marked with a degree of uncertainty—but the less a CEO understands about their firm’s cash runway, the more justified that fear will be.

Properly managing cash in a SaaS business is a delicate balancing act. In the early stages, you want to preserve cash—ensuring your burn rate provides a long enough runway to establish product/market fit and build your sales engine. As your business begins to scale, you’ll hit an inflection point, where you need to pump cash into sales and marketing to grow fast and aggressively build market share.

How much cash should you preserve in the early stages of SaaS growth? When is the right time to invest heavily in sales and marketing? What warning signs prompt the need for a cash infusion? How much cash do you need to reach your next growth milestone? How will you allocate that capital wisely? These and other common questions highlight the need for a clear understanding of your cash flow at any given point in time, so you can make informed decisions based on accurate data.

Understanding your cash burn rate until you’re cash flow positive—and your cash flow projections once you are—is required to survive and thrive as a SaaS firm. In this article, we’ll explore both cash management tools, how to use them, how they provide two different perspectives, and why you need both, so you can grow without the constant fear of running out of money.

Cash Burn Rate and Cash Flow Forecasts are Windows into Your SaaS Firm’s Health

Your firm’s cash burn rate provides you with a view into the rate at which your operations are consuming cash, based on your recent operating history. Your cash flow forecast projects how much cash your firm will produce (or burn) over the projected period. Both provide the data SaaS firms need in order to manage cash, as well as the necessary insight to guide important growth decisions, so you can stay on course.

While both of these cash management tools have a similar function, they work in different ways:

- Cash burn rate is backward-looking, helping you to understand how quickly you’re spending cash and—when combined with your cash balance—how long it will last.

- Cash flow forecasting is forward-looking, helping you to predict and plan for your future cash flow needs.

What is Cash Burn Rate?

Cash burn, often referred to as “negative cash flow,” is quantified by the rate at which a company is spending its cash over a specified period.

Investors place a high-degree of importance on cash burn rate, as it reflects a SaaS company’s spending habits and how long it can continue to spend at that rate before it runs out of money. Burn rate is a key SaaS metric investors use to understand how much more money is needed to sustain a company’s growth, and whether new strategies are needed.

For SaaS founders and CEOs, running out of money isn’t an option. Cash burn rate, used in conjunction with cash balance, provides a critical view of how much runway they have left at current spending levels. It can signal the need to take decisive action early, and avoid worries about not being able to pay the bills. Without these insights, opportunities are missed, decisions are made in the dark—and the fear of running out of cash is real.

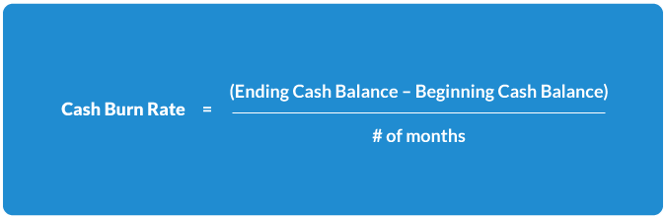

Calculating Cash Burn Rate

To calculate your cash burn rate, you need three measures:

- The number of months in the period you are using to measure the burn rate.

- The cash balance at the beginning of the period.

- The cash balance at the end of the period.

Cash Burn Rate Benchmarks

For SaaS companies, the benchmark for cash burn rate depends on a few different factors. But, as a rule of thumb, companies bringing in $2.5M to $10M in ARR can expect a burn rate of between $275K and $550K, depending on growth rate. The higher your growth rate, the closer you’ll be to the $550K benchmark.

How to Use Cash Burn Rate

A negative cash burn rate means you’re spending more than you are earning and have a negative cash flow. A positive cash burn rate means you’re bringing in more than you are spending and are increasing your cash reserves.

It’s worth noting that SaaS companies typically experience a period of negative cash flow in the early going, but as customer acquisition cost (CAC) comes down, along with the time it takes to recoup those costs (CAC payback), those firms will turn cash flow positive—provided they keep client churn in check.

The time period you use to calculate your cash burn rate is flexible, but strategic. For example, it’s common to use a three-month trailing average to see recent trends in cash burn, while a 12-month trailing average can normalize particularly volatile or irregular months for a big-picture view.

As previously mentioned, your cash burn rate is particularly helpful in gauging your runway. When you know exactly how long your business can continue to pay for expenses at its current rate, there’s often time to make necessary adjustments before it’s too late. When your months of runway shrink to single digits, for example, it may be time to raise equity or look into debt financing. While it can easily take six months or more to secure funds, you’ll want to start that process as early as possible.

Internally, cash burn rate helps your founders, board members, and other stakeholders understand business viability based on current spending patterns. It’s central to aligning strategic decisions on hiring, pricing, capital investments, fundraising, and other areas where cash flow and timing is critical to the sustainability of the business.

Understanding Cash Flow Forecasts

A cash flow forecast estimates the cash inflows and outflows of your SaaS business over a certain period of time in the future.

As with cash burn rate, these time periods are flexible, depending on the purpose of the forecast and your business needs. Typical cash flow forecast periods are by the week, month, quarter, or year. Cash flow forecast is a forward-looking metric. It tells your management team, board, investors, lenders, and other stakeholders how much money your SaaS business will need to meet its future financial commitments.

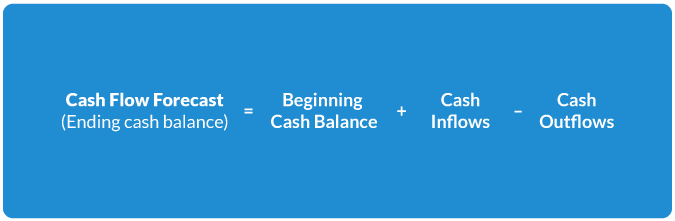

Preparing a Cash Flow Forecast

To calculate a cash flow forecast, accurate inputs are essential. After all, you’re making future predictions based on current data. It can take time, and a lot of practice, to get forecasts right—but will be well worth the effort. The information you’ll need:

- The time period that you want to forecast for. This can be flexible, but you should only project out for as far as you have reliable data. This will help to enhance accuracy.

- Your beginning cash balance at the start of the period.

- The total of your cash inflows. Common inflows include customer subscriptions, service revenue, royalties, grants, interest, and capital investments and receipts

- The total of your cash outflows. Common outflows include payroll, COGS, rent, sales and marketing costs (CAC), loan payments, and taxes.

The Importance of Cash Flow Forecasts

Cash flow forecasts reveal your future cash flow needs and help ensure you have enough money on hand to meet your financial commitments. This gives you a better understanding of likely surpluses and shortages, and where they might be in your business. When you can confidently forecast your ability to pay suppliers, employees, and lenders, the fear of running out of money isn’t constantly threatening your growth plans.

As a strategic tool, cash flow forecasts also uncover opportunities to invest in growth. For example, you can look at cash generated by customer segment or product to determine where to double down, and if changes need to be made first. Forecasts will also prepare you to credibly present your financial story to the board and prospective investors.

Cash flow forecasts are an essential tool for exploring different scenarios and business models, from hiring more staff, to expanding into new markets, to introducing new products. Forecasts also help to align your teams and drive informed decisions on expenditures and investments, while removing crippling anxieties about cash shortfalls along the way.

Remove the Fear of Running Out of Money

Understanding your cash burn rate and generating cash flow forecasts are the keys to eliminating the biggest concern for SaaS businesses—running out of money. You can only take the right risks, make informed decisions, and maximize enterprise value when you're not constantly second-guessing your financial position.

Align these cash management tools with the right team, the right metrics, and the right process, and you’ll have the confidence to turn financial data into decisive action at every stage of your company’s growth.

How? With an outsourced CFO service for SaaS companies, even early-stage firms can harness the expertise of high-level financial leadership and a complete finance and accounting team.

Learn more by scheduling your introduction to Driven Insights today. You’ll receive a free proposal and discover a cost-effective way to have all the finance resources your business deserves, today and as you grow.