Every SaaS founder wants to maximize their company’s value—a goal that requires high performance in two key areas: growth and profitability. In fact, the more you can demonstrate a combination of revenue growth and operational efficiency, the better your chances of attracting investors and earning a higher valuation multiple.

A key SaaS metric that helps tell that story is the Rule of 40.

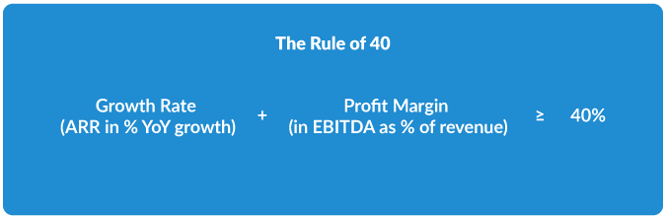

The Rule of 40 combines your growth rate and profit margin to gauge the overall health and potential of your SaaS company. For investors, the Rule of 40 is a high-level KPI they can use to quickly understand the attractiveness of your business relative to others.

The Rule of 40 isn’t just helpful for investors. SaaS businesses rely on this metric to determine whether they should prioritize growth efforts or focus on profitability at any given point in time.

While the Rule of 40 may seem straightforward on the surface, there’s more than meets the eye. Understanding how to properly calculate—and interpret—this Rule of 40 SaaS metric is essential. With a firm grasp of the formula and its use, you’ll have an accurate view of your company’s health and the insights you need to boost performance and valuation.

What is the Rule of 40?

The Rule of 40 holds that the sum of a SaaS company’s growth rate and profit margin should be 40% or more.

A high-level health check for SaaS companies, the Rule of 40 is a common way for leadership to balance the performance of growth against profitability. As a benchmarking tool, the Rule of 40 is also frequently used by general partners at later stage venture capital firms to assess the financial health and relative attractiveness of prospective SaaS investments.

How to Calculate the Rule of 40 for SaaS Businesses

To calculate the Rule of 40, you’ll need two key pieces of data—growth rate and profit margin—both expressed as percentages.

Growth Rate (%) + Profit Margin (%) ≥ 40%

To get the calculation right, however, requires the proper measure of growth rate and profit margin. Both of these components can be defined in multiple ways, so it’s important to have a clear understanding of which you will use.

Defining Your Growth Rate for the Rule of 40

There are numerous ways to quantify your growth rate and they aren’t interchangeable when it comes to the Rule of 40 calculation. Should you measure revenue growth, changes in cash flow, or some other metric? What kind of revenue should you consider? GAAP, Monthly Recurring Revenue (MRR), or Annual Recurring Revenue (ARR)? Should project revenue or professional services revenue be included? As you can see, it’s not so simple.

Our recommendation to quantify growth rate: Use year-over-year (YoY) growth in Annual Recurring Revenue (ARR).

Defining Profit Margin for the Rule of 40

Just like growth rate, there is more than one way to determine your company's profit margin. You could choose between gross profit, operating income, net income, free cash flow, EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), EBIT, or something else—and risk distorting the Rule of 40 calculation.

Our recommendation: Use EBITDA. This measures profits without having to consider factors like financing costs, interest, depreciation, amortization, or tax tables.

With the correct figures in place, your Rule of 40 calculation should be:

Why the Rule of 40 is Important

The SaaS Rule of 40 serves two valuable functions. First, it helps SaaS leaders understand the balance between a company's growth and a company's profitability—two distinct priorities that change over time. Second, the Rule of 40 provides investors with a common yardstick to gauge the potential of different SaaS businesses.

As your SaaS business advances through each growth stage and matures, your priorities will shift. Your focus will move from initial demand to product/market fit to pure revenue growth. Then, it will evolve to sales efficiency, optimizing unit economics, and maximizing profit margins.

The Rule of 40 lets you understand how growth and profitability work together—-whatever your growth stage. In the early stages, you may be compromising profitability in favor of growth. As growth levels off in the later stages, the opposite may be true. In either case, the Rule of 40 helps to identify the areas that need the most attention and which levers to pull.

Examples of insights provided by the Rule of 40:

- If your growth rate is 25%, then profitability should be 15% or better.

- If you’re growing at 50%, the rule suggests you’re in good shape at -10% profitability.

Although the Rule of 40 should never be used in isolation, it is a valuable tool that helps founders, CEOs, board members, management, investors, and other key stakeholders align on a common measure of company health.

The Rule of 40 Can be Hard to Achieve

The Rule of 40 is not an easy target. A 2021 survey of privately-held SaaS companies found that only 29% of businesses with an ARR of at least $5 million met or exceeded a combined rate of 40%. The median result for that cohort is 19%. Public SaaS companies were more successful, with a median combined growth and profitability margin of 33%, but 70% were still below the Rule of 40 threshold.

Despite the challenge, the Rule of 40 remains a worthwhile target. Investors consistently reward SaaS firms that achieve the 40% mark with higher valuation multiples. In fact, reports show SaaS businesses that beat the Rule of 40 earn twice the valuation of those that don't meet it.

When to Use the Rule of 40 for SaaS Businesses

The Rule of 40 is frequently used for large, established SaaS companies with $50MM or more in ARR, but data suggests the rule can work once a firm hits $1MM in MRR and smaller firms are increasingly measuring this KPI.

However, because early-stage startups often beat the Rule of 40 with rapid growth, this target can obscure potential shortcomings with profitability. A good rule of thumb is for younger SaaS companies to focus on unit economics—customer acquisition cost (CAC), lifetime value (LTV), CAC payback, and churn—until they hit “T2D3” growth.

T2D3 means “triple, triple, double, double, double” and refers to a company tripling its annual revenue for two consecutive years, then doubling it in the next three. Once a startup achieves this type of growth, and has solid unit economics, it's ready for the Rule of 40.

How Saas Companies Can Meet and Beat the Rule of 40

For smaller, early-stage SaaS businesses, it’s important to focus on growth first. Even if you’re not highly profitable yet, consistent revenue growth will be the driving force in your effort to beat the Rule of 40. Priorities include establishing a large, installed base and setting realistic growth targets.

For larger, established companies with growth that is leveling off, it’s more difficult to maintain the rule beyond a single year at a time. These firms need to rely on the profitability side of the equation to get past the 40 mark. Pricing strategy, expansion revenue, product development, R&D, and new business models are among the areas to focus on here.

Maximizing Valuation with the Rule of 40

Although it can be challenging to meet the Rule of 40, it's a valuable tool for SaaS firms looking to maximize enterprise value. It tells investors you’ve got the right balance of growth and profitability, highlighting the potential for future returns. At the same time, it provides SaaS companies with critical insights that help to prioritize their growth and profitability targets.

However, the Rule of 40 is just one tool in the SaaS leader’s toolbox—and no metric is a one-size-fits-all solution. Defining the right mix of KPIs at each stage of your company’s growth and aligning your team on the right way to use them is essential—and why it’s never too early for high-level finance leadership to guide this practice.

With an outsourced CFO service for SaaS companies, even early-stage firms can harness the expertise of high-level financial leadership and a complete finance and accounting team to ensure accurate, timely data is informing every decision.

Learn more by scheduling your introduction to Driven Insights today. You’ll receive a free proposal and discover a cost-effective way to have all the finance resources your business deserves, today and as you grow.