As the founder, CEO, or key stakeholder of a SaaS business, you need a clear picture of the day-to-day health of your business. In theory, SaaS metrics can satisfy this need with basic formulas for calculating a variety of performance data. In practice, however, there’s much more skill required to surface the right data, the key SaaS metrics, to provide critical insights, and drive informed decisions.

Consider churn, an essential software-as-a-service metric that measures the flow of customers and revenue leaving your business. Like most SaaS KPIs, churn is not a one-size-fits-all metric. There are several different types of churn, each with their own formula and use cases. In order to effectively manage churn, you must know the churn calculation of the different types, when to use them, and how to interpret the resulting information.

In this article, we’ll explore 3 ways to measure SaaS churn, and why each is important, so you have the right tools to maintain positive growth for your SaaS business.

Why Churn Matters for Every SaaS Business

Churn isn’t just another SaaS metric. In fact, it’s one of the most important SaaS metrics when it comes to valuation, as it has a direct impact on your ARR growth rate and customer lifetime value (LTV).

Annual Recurring Revenue (ARR) growth rate represents the change in annual recurring revenue over a given period. For SaaS companies, it is one of the key measures of year-over-year growth and is often the primary driver of valuation.

ARR growth is impacted by:

- Subscriptions from new customers (customer acquisition) and one-time purchases (increases net new ARR)

- Expansion revenue from upselling and cross-selling your existing customer base (increases net new ARR)

- Contraction, or revenue lost due to downgraded subscriptions (decreases net new ARR)

- Churn, due to how many customers canceled subscriptions (decreases net new ARR)

Trying to maximize ARR growth with high levels of churn is like trying to fill a leaky bucket. Adding water to the bucket is like customer acquisition for the business, while the water leaking out is like churned customers. The bigger the leak, the harder it will be to accumulate water in the bucket.

In other words, SaaS businesses with a churn problem will be fighting an uphill battle with both ARR growth and customer lifetime value.

The Many Faces of SaaS Churn

Different departments within a SaaS company will interpret and respond to revenue churn in different ways. A customer success team, for example, might focus on boosting the retention of paying customers with a program that incentivizes early renewals. A product team, on the other hand, might contribute by developing new features that have been requested, increasing customer satisfaction. Because multiple department heads may be responsible for churn, it is essential to align on a clear definition and consistent formulas for churn calculation.

Three Common Ways to Calculate SaaS Churn

Churn is always a measure of customer attrition or loss, yet it can be viewed in different contexts. Let’s look at three ways to calculate this key SaaS metric, and how each provides unique insights.

1. Customer Churn (Logo Churn)

Customer churn refers to the number of customers lost over a specific time period due to canceled subscriptions.

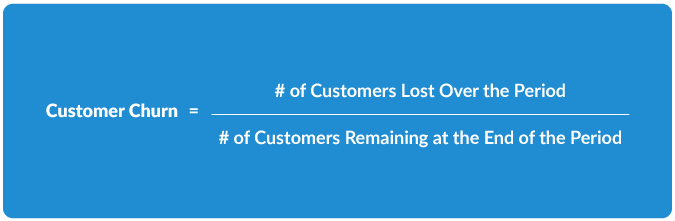

How to calculate customer churn:

Customer churn is appropriate when gauging the effectiveness of your customer retention efforts, or when seeking to understand why customers are leaving. It is important to note that causality may be attributed to either voluntary or involuntary churn.

Voluntary churn represents a deliberate action taken by a customer, such as a cancellation due to a poor product experience and low customer satisfaction.

Involuntary churn refers to an unintentional action, such as a credit card expiration. In both cases, an effective strategy to reduce customer churn will require digging beyond the surface level churn metrics to identify the root cause.

2: Gross Dollar Churn

This SaaS churn metric measures the total amount of revenue you have lost through:

- Customers leaving your business (customer churn)

- Customers downgrading their subscriptions (downselling)

It is important to note that gross dollar churn is a measure of lost during a period and does not take into account revenue gains from upselling.

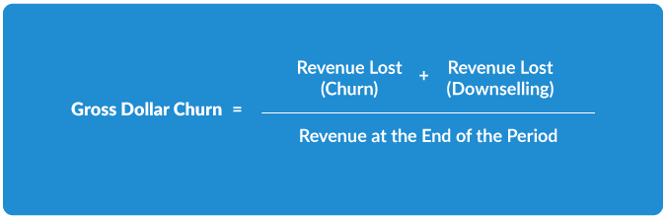

How to calculate gross dollar churn:

While customer churn only reveals the number of customers lost during a period, gross dollar churn accounts for the revenue associated with each of those customers—which can vary widely. Used together, both figures will provide a more accurate measure of the impact of churn.

3: Net Dollar Churn

This SaaS churn metric accounts for the total amount of revenue lost and gained from your existing customer base in a period, and includes:

- Customers churning out of your business (customer churn)

- Customers downgrading their subscriptions (downselling)

- Customers paying more for additional services (upselling)

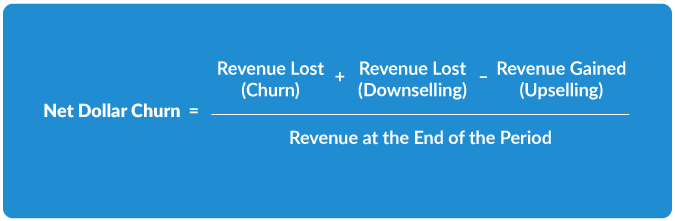

How to calculate net dollar churn:

Net dollar churn can be negative, and that’s good. It means your company is still growing through upselling existing customers, even if you don’t acquire customers. Optimize for this with solid cross-selling and upselling strategies, encourage existing customers to bring on more user seats, and consider additional efforts to boost contract values.

There are several other ways to calculate churn, and they each measure revenue and customer loss differently. However, the three approaches outlined here provide a solid foundation, as they will highlight different trends and raise the right questions on your continuous quest to curb churn and drive retention and increase customer lifetime value.

Benchmarking SaaS Churn

You’ll want to compare against churn benchmarks to see how your company’s performance compares to that of other companies in the SaaS industry. However, identifying an acceptable churn rate can be tricky, especially for younger startups without much historical data.

It’s important to remember that benchmarks are only useful when your underlying calculations are the same as the benchmark. In other words, when you’re comparing apples to apples.

For example, mature SaaS companies with a mature product and established customer engagement will typically have lower churn than a high-growth company with a newer product that is offering free trials and discounts to attract as many new customers as possible.

Blindly comparing your churn rate to SaaS industry benchmarks or SaaS businesses with a different set of calculations or circumstances can easily result in misguided decision making for your business model.

The annual KeyBanc Capital Markets SaaS Survey is one great benchmarking resource that is particularly useful because it presents data for private and public SaaS firms.

Expressing Your SaaS Churn Figures

It’s helpful to express churn as both an absolute figure and as a percentage. Your absolute figure will help drive decisions about operational needs, like runway and expenses. The percentage figure will show the effectiveness of churn reduction techniques over time, as your business grows and becomes more efficient.

Segmenting SaaS Churn

There are limitless ways to segment churn in SaaS companies. With the ability to analyze churn on a granular level, you can dig deeper to identify root causes and take corrective action in every part of your organization.

Churn metrics can impact each and every department in a SaaS company. As such, all managers and key stakeholders must align on a common definition of churn and consistent formulas for each churn calculation. Which types of churn will be measured? What segments will be tracked? Unanswered, these and other questions can easily lead to faulty data and a cascade of misinformation.

Common ways to segment churn include:

- Churn by marketing campaign

- Churn by promotion

- Churn by product

- Churn by length of sales cycle

- Churn by functional usage

- Churn by licensed modules

- Churn by sales channel or organization

- Churn by industry or market segment

- Churn by customer size or other customer segmentation such as geography or cohort

- Churn by total annual recurring revenue by customer or contract size

Experiment with different ways of slicing and dicing your churn analytics to discover the most useful segments to include in your monthly close.

Related Content: Choosing the Right Subscription Management Platform

Explore 9 essential criteria for selecting a SaaS billing tool.

Know When (and How) to Use the Right SaaS Metrics

On the surface, SaaS churn can seem like a straightforward measure of revenue leaving your business. But, to truly grasp how churn is impacting your growth goals—and take effective action—requires a deeper understanding of this key SaaS metric.

In fact, the same goes for most other SaaS metrics. When firms don’t properly define, calculate, and interpret metrics, the resulting inconsistencies often lead to costly miscommunications and inaccurate financials, ultimately taking a toll on valuation.

Whether you’re an early stage bootstrapper or a growth stage startup, the same rule applies: Sound metrics and solid financials are a prerequisite to increasing valuation. An experienced SaaS finance and accounting team is essential, but building one requires a significant investment in time and money. Fortunately, there’s an easier way.

Schedule an introduction to Driven Insights to learn how an outsourced CFO service can tailor a complete, team-based, finance and accounting solution to your SaaS firm’s needs—today and as you grow. You’ll get a free proposal and a plan to take control of your firm with flawless financials that drive maximum enterprise value.