Let's face it, the vast majority of small business CEOs and nonprofit executive directors are flying blind when it comes to having sound, data driven insights upon which they can base their decisions. For a variety of reasons, the finance functions in these organizations just don't produce insightful reporting their leaders can lean on. Instead, their finance team is focused primarily on recording their financial transactions with their tax returns in mind as the end game.

Couple this reality - that is, the lack of financial and operating insights - with the fact that there's a lot of noise when it comes to business intelligence, and business leaders find themselves in a bit of a pickle. One well-meaning adviser might tell you to watch this metric while another says you need to measure that key performance indicator (KPI). Suggestions come from every corner of the small business world. So how is a CEO or nonprofit executive director supposed to shortlist the right metrics to watch for his or her organization? And realistically, aren't these business insights the domain of large organizations with the staff and resources to generate them? Why bother heading down this path when it'll likely be cost prohibitive to produce these metrics once identified?

The fortunate answer to these questions is that small business CFO advisory services can help. And the right services can do so very cost effectively. Refer to our articles that define CFO advisory services and detail the cost of CFO advisory service, but read on to find how the most popular insights they deliver.

How to approach metrics selection

As a starting point, broadly speaking, metrics fall into these four categories:

- Cash

- Profit

- Growth

- Market share

Within each of these areas, one can and should drill down several levels to reveal truly valuable insights. There are countless ways to slice and dice each of these areas so it's important to guide your selection process with your specific needs. Namely, you'll want to start by understanding your top objectives. These goals should be quantifiable and measurable. You'll also want to overlay your industry and stage of growth. For example, we have developed a framework for KPI selection specifically designed for earlier stage software-as-a-service (SaaS) businesses.

Additionally, the most popular metrics we've found in delivering outsourced CFO advisory services across a wide range of industries can serve as a starting point for building a shortlist for your organization. While there are many useful metrics that fall outside those listed here, this list transcends industry. From a venture-backed SaaS firm to a nonprofit, from a managed IT service provider (MSP) to a family business, the below insights and deliverables are are all relevant across the board.

5 Most Popular Insights and Deliverables

1. Cash Management

Nothing is more important in business than understanding your organization's cash position. Best intentions and even lofty profits all fall by the wayside if your organization lacks sufficient cash to meet its obligations.

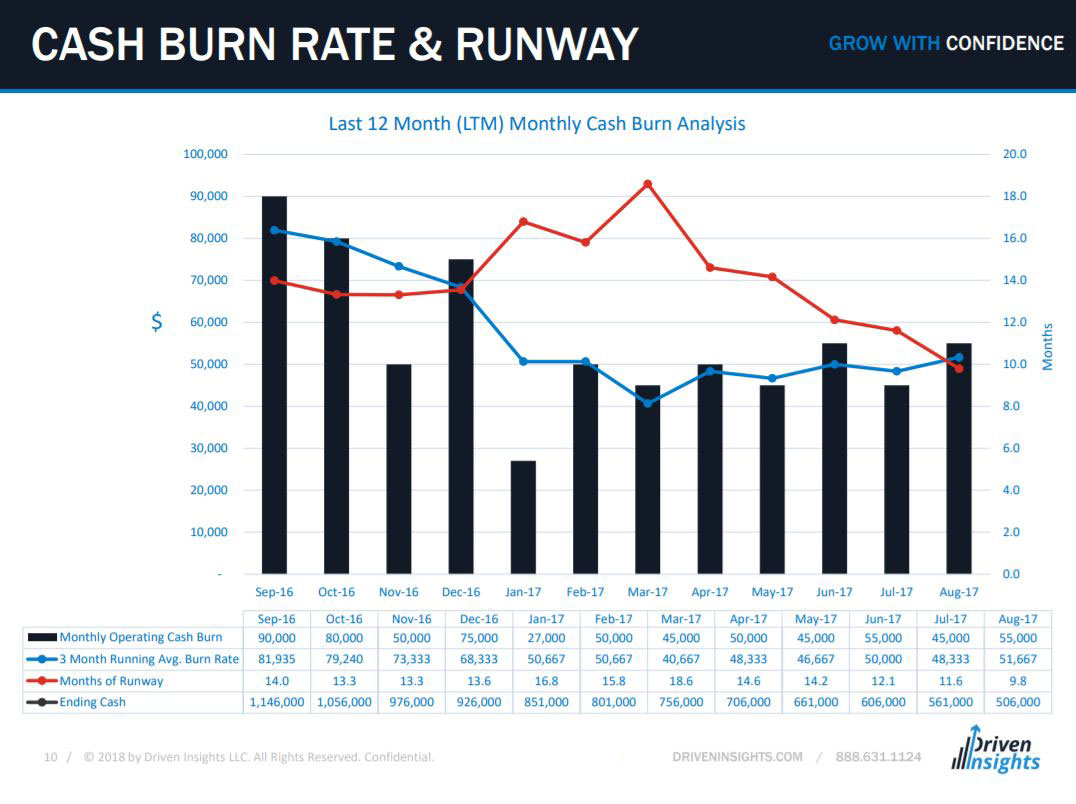

As the leader of your organization, you must understand how much cash you have in the bank (easy), how fast you're burning through it (harder) and how long it will last (hardest, due to the variables involved). All of this data can be packed into a single view as you can see below. Growing and shrinking revenue can both lead to cash shortfalls and in such situations you often need this information to make the hard decisions on which bills you can pay, and when.

Cash flow projections are also a critical planning tool as they provide visibility into your future cash position. Projections can ensure you'll never be blindsided by a cash shortfall and provide you with an advanced warning when such a crisis is on the horizon. Such a warning will enable you to take the necessary actions to prevent it altogether or navigate through it when it does arrive.

2. Profit Planning

Many business owners' profitability analysis starts and ends with looking at the organization's net income on the P&L. But gaining more detailed visibility into profitability can be game-changing. As an example, let's take a SaaS business, which takes its payment over time via a subscription. That firm must make the sales and marketing investment up front even though payment is received in the future. If you don't understand the unit economics - that is the profitability of a single customer - you won't know if your SaaS firm will ever reach profitability. That is why measuring the cost to acquire a customer (CAC) and customer lifetime value (LTV) and the LTV/CAC ratio are fundamental to understanding if the ingredients are present for a viable business... long before your overall firm achieves break-even. These profit data are critical for fundraising. Investors will consider it a prerequisite to an investment.

Or in the case of a nonprofit, understanding each program's profitability will be of paramount importance in determining what changes would be required to achieve sustainability. Moreover, donors will want to understand the profit picture and overall financial story before backing your organization.

3. Budget

A budget helps bring your strategy to life as the financial roadmap used to make it a reality. A budget is where your growth goals are put down on paper and all the financial realities of hitting those goals come into play. Used effectively, a budget is an incredibly powerful tool because it gets your entire team pulling toward common, quantifiable goals. It measures your progress along the way and simultaneously can be used to hold your team responsible for holding up their end of the bargain. With department level visibility, you department heads can no longer hide behind the cloak of the financials for the entire organization when their department falls behind plan.

4. Value Drivers

Business owners like to see their business increase in value over time, just as a nonprofit executive director wants to see its impact grow. Typically, the faster the better. But unless they're monitoring the underlying drivers of growth, it's difficult to proactively manage that growth. For example, an MSP is valued based largely on its monthly recurring revenue (MRR). Whether seeking growth capital that requires a valuation or looking to sell, the MSP owner should keep a watchful eye on MRR. Doing so has far reaching impacts on resource allocation. For instance, hitting the next milestone in MRR growth might cause you to focus more marketing and sales resources on adding more recurring services over campaigns to win one-time hardware sales or project service revenue. What value drivers should you watch? An outsourced CFO advisory service would identify the right drivers and establish mechanisms to monitor them.

5. Current Initiatives

It seems that every business owner or nonprofit leader has at least one pet project — or a current initiative that he or she is pushing in parallel with day-to-day operations. It’s critical to quantitatively measure the performance of these initiatives. Doing so lets you monitor progress, and it drives decisions behind resource deployment. After all, an owner should depend on more than gut instinct to decide whether to sunset a project or invest additional resources. Let’s say you want to experiment with a new variable compensation program for select employees. Presenting the variable month-to-month compensation an employee (or group of employees) earns over top of his/her productivity in a single view can show the correlation — or lack thereof — between the two.

KPI Selection is One Thing, Using them to run your organization is another

Once you've selected your KPIs - regardless of which metrics you settle on - you're only partway down the path to informed decisions. Next you must give careful thought to how you are going to cost-effectively produce these insights week after week and month after month. That includes the right mix of talent, technology and accounting process and controls (to ensure errors are caught).

With the process in place to generate the insights you need, you can then turn your attention to presentation. That is, how should you present the information in a way that you and your stakeholders can understand and use without spending precious time trying to glean the value from the data. That's where a carefully designed dashboard comes in. Prepared correctly the data should leap off the page and serve as grab-and-go decision making fodder.

If we can lend a hand in delivering cost effective insights to your organization, please reach out: info@driveninsights.com, 888-631-114.