Ask any small business owner what a budget is and they will likely respond with something like this: a financial plan for a firm's future that projects revenue and expenses. Ask them if they have one, however, and you may get a variety of excuses why they don’t. The truth is, many entrepreneurs far underestimate the value of a budget in their business.

So, Why is Budgeting Important for Business?

A solid budget serves as a road map for a business owner to ensure they are on track to meet their goals as they navigate through each month, quarter and year. And budgets don't have to be complex to be effective. Out of the gates, a simple estimate of monthly revenue and expenses is just as powerful as a fully integrated financial report that includes a profit and loss, balance sheet and cash flow statement. The point is to establish definitive sales and spending targets that you can use to gauge the success of your business strategy. It also helps estimate monthly expenses, account for fixed costs, and anticipate unexpected costs before they arise. Aside from being a benchmark, a budget is also an important tool that can actuate change.

Budgeting helps you allocate resources wisely

For example, a budget allows small businesses to allocate financial resources efficiently, ensuring that funds are directed toward essential daily operations and growth initiatives. By having a clear understanding of revenue projections and operating and fixed expenses, business owners can better manage cash flow, avoid overspending, and prepare for one-time expenses or unforeseen circumstances.

Take a service-based business, for instance, like a consulting firm - a budget might help prioritize spending on billable staff hours and software tools while deferring non-essential expenses like travel or office upgrades. If a major client project is delayed, the budget allows management to understand the impact on cash flow of adjusting staffing schedules or reallocate hours to internal business development work, avoiding idle time while keeping the business financially on track.

Better insights, smarter decisions

A well-constructed budget also facilitates better decision making by providing insights into which areas of the business are performing well and which may require adjustments. This is a proactive approach that not only helps control costs but also supports strategic planning.

Ultimately, a budget is a dynamic tool that reflects actual performance against planned goals, making it easier to track income and expenses throughout the fiscal year and maintain financial stability.

Let’s Be More Specific: why the budgeting process is vital

1. Curbs overspending and controls variable costs

Owners and department managers will more carefully consider their purchases if there are spending limits – and accountability if they exceed those limits. By setting clear spending limits, a budget encourages managers to prioritize essential purchases and evaluate the necessity of each expense. These spending limits help prevent impulse buying or unnecessary expenditures that can disrupt the financial stability of the business.

However, disciplined spending doesn't mean deprivation. The beauty of a budget is that it illustrates how the numbers are connected; how an increased expenditure in one department can be balanced by a decrease in another. This is especially true for variable expenses, where a lack of budgeting can lead to volatility across departments. The interdepartmental planning and understanding incites managers to work together more frequently and avoid overspending without sacrificing necessities.

Early detection of cost overruns

Also, controlling variable costs through budgeting allows businesses to adjust their spending in response to changes in revenue or market conditions, and enables early detection of cost overruns or inefficiencies, allowing timely corrective actions.

When managers understand the impact of their spending on the overall financial health of the company, they are more likely to make informed decisions that support both short-term needs and long-term business goals.

2. Motivates employees and aligns financial goals

It's important to communicate the company's goals to your team, and make it clear that the budget makes it possible to fund those goals. A simple statement like, “We need to make $X in sales and spend no more than $Y in expenses in order to have the funds to expand into Z market by the end of the year,” gives employees a quantifiable goal on which to focus. A budget may even inspire staff members to think outside the box for solutions to sales shortfalls or expense overages in an effort to help the company hit its targets. The result is a unified, engaged and committed team, which in turn, reflects on the company.

Promotes transparency and inspires ownership

Beyond motivation, clear communication about the budget promotes transparency and trust within the entire organization. When employees understand how their roles and departments contribute to the overall financial plan, they are more likely to take ownership of their responsibilities and align their daily activities with the company's strategic priorities. Alignment like this helps ensure that resources are allocated efficiently and that everyone is working toward the common objectives.

Involving employees in budget discussions or updates can lead to new, valuable insights and identify opportunities for cost savings or revenue growth that management might overlook.

3. Keeps stakeholders aligned on financial data and strategic priorities

Of course, investors, shareholders and other interested parties want your company to succeed, but they also need to protect their interests. So when you want to expand your business in any way (which always results in increased expenditures), it's in your best interests to have a solid budget in place to get stakeholders on board with your goals.

Use the budget to build trust with investors

When all parties are in agreement with the company's objectives and the plan for meeting them, it's much easier to gauge progress and work together to keep the company on track. This shared clarity is rooted in your financial data, which helps stakeholders align around your strategic priorities.

A comprehensive budget provides a transparent view of your company's financial health, including projected revenue, operating expenses, capital expenditures, and cash flow. This transparency promotes trust and confidence among stakeholders, as they can see exactly how resources are allocated and how the business plans to achieve its goals.

Keep everyone informed and engaged

Furthermore, a well-maintained budget serves as a reference point during discussions and decision-making processes, ensuring that all parties are informed and engaged. Regularly sharing budget updates and actual results with stakeholders also allows for early identification of any variances between planned and actual performance, enabling timely adjustments to strategies or resource allocation.

Ultimately, keeping stakeholders aligned through a clear and detailed budget supports sustained business growth and strengthens relationships with those invested in your company's success.

Get Started on Your Budget

The question isn't so much, “Why is a budget in business important?” but rather, “How do you get started on a budget for YOUR business?” Once you begin using a budget, you will realize additional benefits unique to your company. This is especially true for small firms building their first small business budget. If you're new to the budgeting process, stay tuned for our upcoming series on budgeting for tips. Meantime, Harvard Business School offers some useful tips for crafting a business budget. Don't delay in using this important tool to keep your company thriving and on course. A cash flow budget or even a simple operating budget can make a major difference in your company's financial health.Driven Insights Advantage

Need additional help? Talk to us about how we can lend a hand with creating a budget and other valuable reports for your business. Outsourcing your accounting function frees you from tax-time stress and empowers you to make better business decisions.

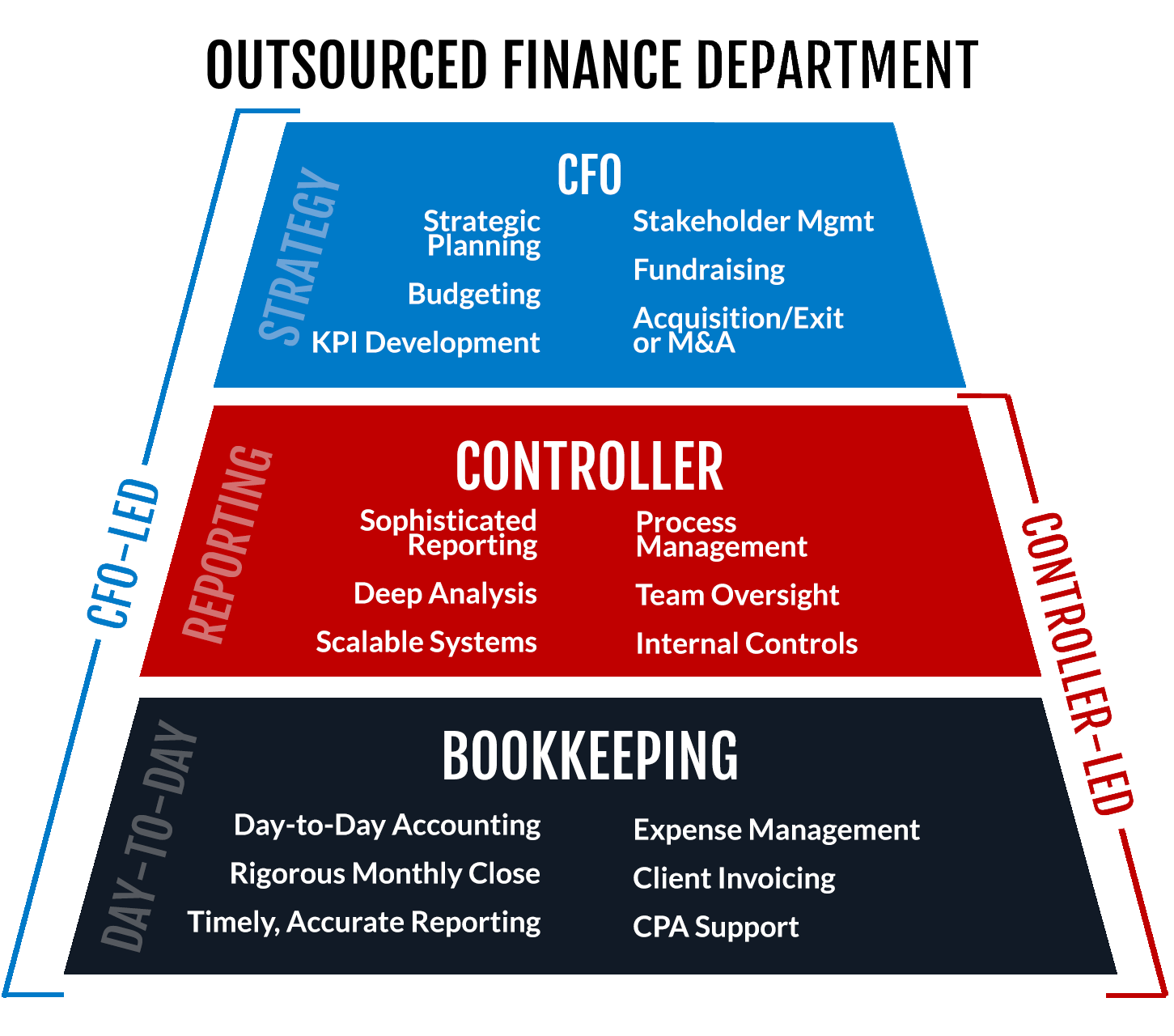

You can see how our accounting services are structured in the graphic below.

Tired of making decisions in the dark? Reach out to info@driveninsights.com or read about our services to learn how we can help eliminate your finance function from the list of things to worry about.