Profits don’t pay bills, cash does. Just because a firm is profitable doesn’t mean it won’t run out of cash.

Cash flow projections may be the single most important business planning activity you perform, in good times or bad. Whether you are wondering if you can afford that next hire, take a dividend or simply make the upcoming payroll, a view into your future cash position will arm you with your answer.

While predicting the future seems daunting, take these steps to systematically, efficiently build your first projection.

1. Look Back

Cash flow projections are simply about measuring the inflow/outflows of cash and the resulting change to your cash balance. But before you try to project the future, it’s helpful to take an objective look at your firm’s recent history.

Have your bookkeeper or controller run a report to see what cash went in and out of your business last month.

- Deposits and Payments: Look at each deposit that came in. Were there any royalties or other sources of revenue that hit your account? Inspect each payment you made. Note which deposits/payments are recurring versus one-off.

- Schedule: Now think about payments and deposit schedules. Which occur daily, monthly, quarterly or annually? Which customers pay on time and who tends to drag their feet? How late do they typically pay? All of these ingredients help you build the ingredients for your cash flow projections and get your arms around the financial rhythms of your firm.

2. Look forward

Now that you have a rough list of historic payments and deposits, let’s look to the future. A 4 to 6-week projection is a great starting point. Here’s an account-by-account guide to making your first projection.

Accounts Receivable:

- Services Delivered: Use your Accounts Receivable Aging report, coupled with customer payment history, to project the timing of cash coming in. Consider the due date, but overlay reality to estimate when it will actually hit your bank account.

- Services Planned: Depending on how far into the future your projections go, you may expect payments for services you haven’t yet invoiced. Include this additional level of forecasting.

Accounts Payable:

- AP Aging: Turn to your Accounts Payable Aging report to help detail your anticipated outflows. The benefit to payables is YOU are the one in control of payment timing.

- Payables Expected: As with Accounts Receivable, you may need to forecast some cash expenses for which you haven’t been billed. Rent, utilities or insurance are good examples of expenses you expect, but may not be in your AP aging report. Lastly, don’t forget any one-off purchases.

Payroll:

Salaried and standard payroll is easy to forecast. However, some variable payroll, like overtime or commissions, can be unpredictable. In those instances, use your best estimate based on past experience and understanding of your current resource usage.

Additional Outflows:

Be sure to include other cash payments such as loan payments and owner draws/dividends.

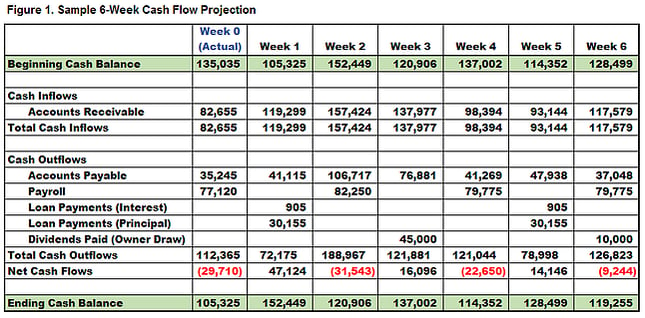

Have your bookkeeper or controller enter their assumptions into a spreadsheet so you can see their impact on the cash flow projections (Figure 1 provides a sample). If things look a bit high or low, review the assumptions. Adjust as you see fit, then set it aside for a week. Reach out if you'd like our cash flow projections template.

3. Refine

Keep in mind, you’re developing a skill. Just as you should assess what went wrong after slicing a golf shot, identify where your projection deviated from reality before adjusting your projections each week. Your cash flow projections will never be perfect since there are too many variables (which influence timing) outside of your control. But the general direction will be correct and you will soon learn to use the “levers” for controlling your future cash position. For example, can you invoice your customers earlier? Should you place that collections call? In a pinch, which payment commitments might have flexibility on payment timeline?

Work to extend the projected time period after a few weeks, ideally aspire to 10 or 13 weeks. The longer the projection, the more time you’ll have to react the next time your projections show you have a cash shortfall ahead.

4. Use

Spend a little time with your cash flow projection each week. Make it a habit, just like glancing at your car’s fuel gauge. You’ll soon find yourself engaging in a healthy series of Q&A that naturally leads you to proactive cash management and makes those knee jerk reactions a thing of the past.

Does your cash flow projections show you’ll run out of cash in 5 weeks? Not to worry. That is actually good to know because you now know how much cash you need to harvest or preserve over the next month to avoid the shortfall. Can you invoice any customers this week? Can you wait to replenish some stock? Will your supplier give you an extra month to pay your latest bill?

Now that you’ve taken action to address the short-term issue, be sure to investigate the root cause of the shortage. Is it a one-time issue, a seasonal reality or is a competitor stealing business? The answer to this question will naturally direct you toward the appropriate solution. Perhaps you’ve already replaced a customer and the payment is scheduled to begin the following week or month. Maybe you want to consider a line of credit to bridge the lean months of the year (NOTE: we’ll cover how to get a loan in an upcoming blog post). Or maybe you need to sharpen your marketing to better articulate the benefits of your services over those of the encroaching competitor.

Considering a big purchase? Have your bookkeeper or controller factor that in to help you find the right time to move forward. There’s nothing like having the peace of mind that the cash will be where you need it when you need it.

In closing, remember:

- start small, looking out just a month or so

- when in doubt, look to your past as a proxy for how things will evolve moving forward

- track actuals relative to your projections and

- adjust the forecast weekly

You’ll be amazed at how quickly the cash flow projections impact your behavior and priorities (and those of your employees). Soon you’ll wonder how you ever managed without it. Lastly, don't forgot to take us up on our offer to send you our cash flow projections template, just shoot us a note.

THE DRIVEN INSIGHTS ADVANTAGE

Driven Insights is experienced in leading service businesses on the journey to leveraging financial and operating metrics to accelerate growth. Our bookkeepers and controllers are charged with much more than simply “doing the books” – they ensure each client understands and uses the insights we share.

Interested in learning more? See for yourself how Driven Insights can provide the insight and control you need to achieve your most critical goals by contacting us at info@driveninsights.com or 888-631-1124.